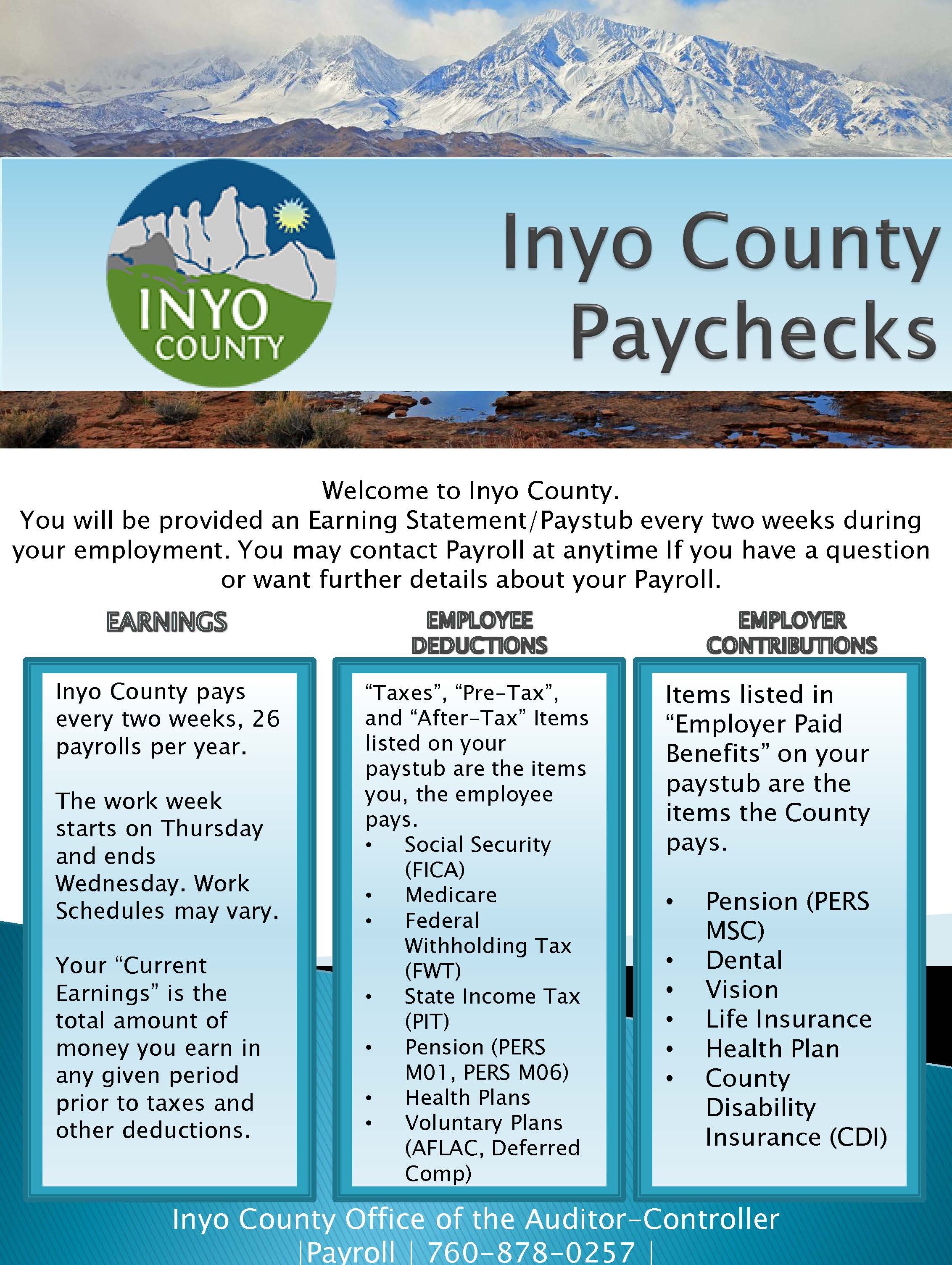

Payroll

The Inyo County Auditor-Controller’s Payroll is responsible for processing employee wages for the County Departments and 11 Special Districts.

- Prepares, calculates and timely pays over 400 employees, including permanent, part time, and temporary employees.

- Maintains employee master payroll data including garnishments, taxes and voluntary benefit programs.

- Implements pay practices negotiated with various bargaining units

- Reconciles payroll data with general ledger and budget records.

- Prepares quarterly and annual reports and ensures compliance for Federal and State Agencies

- Provides comprehensive data for Public Record Requests.

- Maintains compliance with CalPERS, the County’s Retirement Program.

- Issues W-2 and ACA forms to employees.

Frequently Asked Questions

When is Pay Day?

Inyo County pays bi-weekly, every other Friday. Click here to see the Payroll Schedule.

What is the work week?

The work week begins Thursday through Wednesday.

How will I be paid?

The County has determined to pay its employees in one of three ways, at the employee’s election:

- Through Direct Deposit; or

- Through physical check via mail with United States Postal Service; or

- Picking up the payroll check at the Auditor’s Office in Independence, during business hours (Monday thru Friday 8:00AM to 5:00PM) and on the employee’s own time.

How can I change my bank information for my direct deposit?

Personnel can assist you with updating your banking information. During a test of changes to your direct deposit, you may receive a physical hard check.

Your hard check will be placed in the mail unless arrangements have been made prior to payday to pick up the check at the Auditor-Controller’s Office in Independence.

Contact Payroll at 760-878-0257 to set up a pickup arrangement.

My bank account was compromised or closed. What do I do?

If your bank account that is used for direct deposit of your payroll wages has been compromised or closed, contact Personnel right away. It is important that we update your information as soon as possible to avoid any delays in getting your pay to you.

Your banking agency may have additional information on whether your bank account is being closed and how they will be handling any electronic funds transfers or direct deposits received from Inyo County.

Personnel can assist you with updating your banking information. During a test of changes to your direct deposit, you may receive a physical hard check.

Your hard check will be placed in the mail unless arrangements have been made prior to payday to pick up the check at the Auditor-Controller’s Office in Independence.

Contact Payroll at 760-878-0257 to set up a pickup arrangement.

I would like to pick up my physical paycheck. Where do I do that?

You may pick up your payroll check at the Auditor-Controller’s Office in Independence on your own time and during business hours (Monday thru Friday 8:00AM to 5:00PM).

You will be required to sign for receipt of my check and provide identification.

Your payroll check is not negotiable until the actual payday established by the County.

Please make arrangements prior to payday to pick up the check by calling Payroll 760-878-0257 or sending an email.

If arrangements are not made to pick up your physical paycheck prior to the day before payday, the check will be placed in the mail via US Postal Service.

My paycheck was lost in the mail. What do I do?

Paychecks are placed in the United States Postal Service mail receptacle on payday. There exists a risk of unforeseen circumstances beyond the County’s control associated with using the mailing system that may delay timely receipt of the check; provided that the checks are lost or stolen, the County will reissue them as timely as possible.

Please contact Payroll by email or telephone at 760-878-0257 to report your paycheck lost or stolen.

How do I get a duplicate copy of my paystub?

Your department timekeeper will be able to provide you a duplicate copy of your paystub.

How do I get a duplicate copy of my W2?

Active County Employees, please email your request for a duplicate W2 from your County internal email to payroll. Please include the year of the copy you are requesting.

For retired or inactive employees, please send your request by email or mail to Payroll. We will send a copy of your W2 to the address on file. If the address on file in incorrect, please include the updated address and verification of identity with your request.

I have moved, how to I update my address?

Personnel can assist you with updating your address.

What do the codes on my paystub mean?

See the listing of the payroll (contribution, deduction and hour) codes.

For additional information, you may email or call Payroll.

My pay is different that it normally is. Can you tell me why?

You may contact Payroll to discuss your current or previous pay.

Some of the reasons that your pay may fluctuate is:

- Short Term Disability- difference in tax contributions

- Paid Family Leave- difference in tax contributions

- Merit Increases

- Merit increases are implemented the 1st of each month.

- Personnel can address any Merit Increase questions.

- Longevity Increases

- Overtime, Standby Payments

- Miscellaneous Voluntary or Involuntary Deductions

- Flex Accounts, Union Dues, Aflac, Deferred Compensation

- Wage Garnishments

- Child Support

- Tax Withholding Adjustments

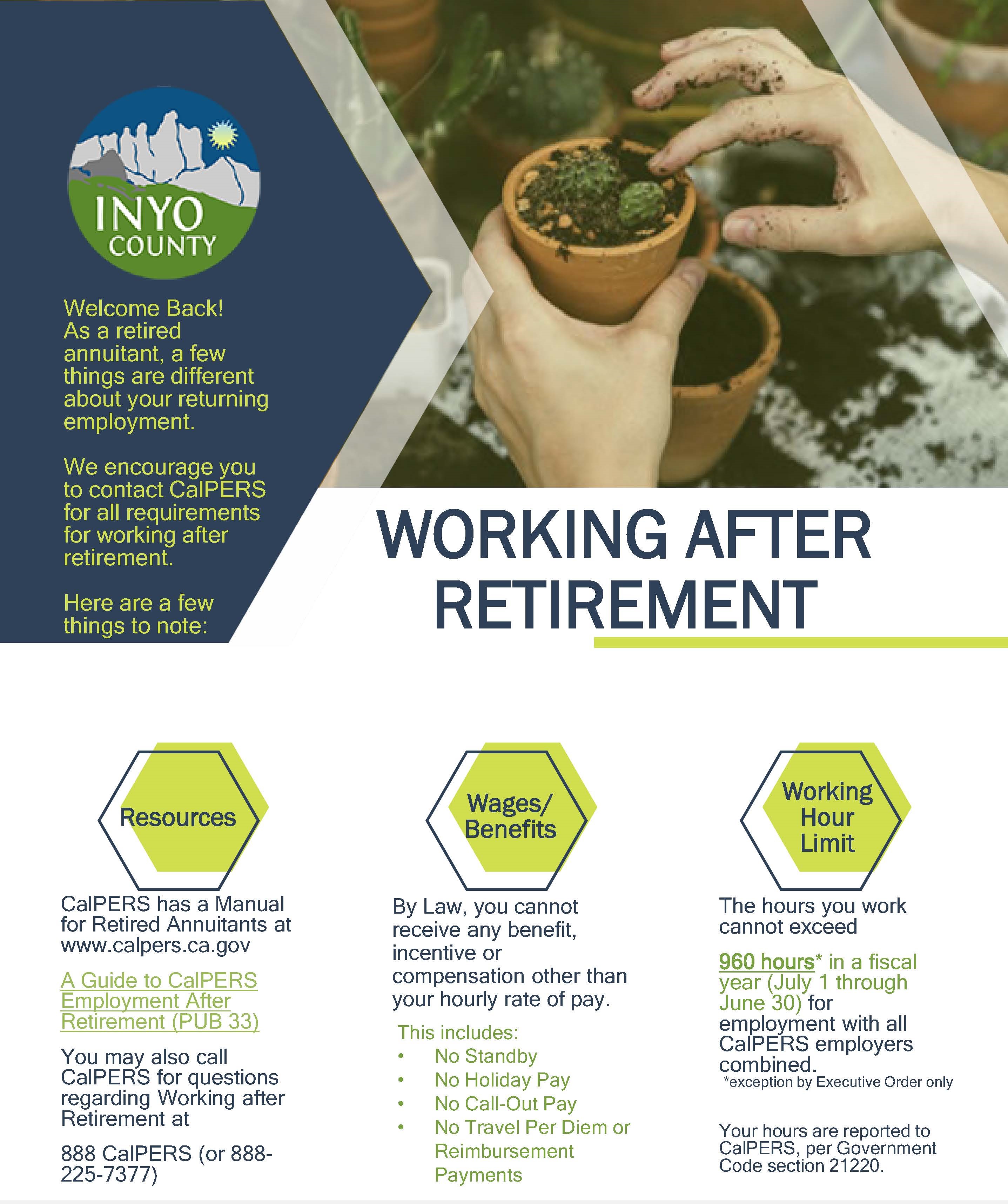

What is the retirement system for Inyo County?

Inyo County contracts with the California Public Employees’ Retirement System (CalPERS). They can be contacted at 888/225-7377 or by visiting their website

What benefits are available to employees of Inyo County?

Benefits for employees of Inyo County differ based on the employee’s classification and type. See Human Resources, MOUs and Benefits for additional information

Policies & Memoranda of Understanding | Inyo County California

Benefits and Salaries | Inyo County California

What is CDI and what are the maximum wages subject to the insurance?

The County of Inyo has a self-insured disability plan, County Disability Insurance (CDI). For additional information about CDI, click here.

I went out on Short Term Disability. Will I get paid a separate check?

The County of Inyo has a self-insured disability plan, County Disability Insurance (CDI). Since the County is funding the payments, you will receive any short-term disability or paid family leave benefit through your regularly scheduled payroll.

You may contact Personnel for further information about your short-term disability or paid family leave benefits.

Who should I contact for questions concerning federal or state income tax returns?

Any questions concerning federal, or state income tax returns must be directed to the local Internal Revenue Service at (800) 829-1040 or Franchise Tax Board office at (800) 338-0505.

Website links:

Internal Revenue Service: Contact Your Local IRS Office | Internal Revenue Service

State of California Franchise Tax Board: Phone / fax | FTB.ca.gov

Ready for Retirement?

CalPERS - Planning Your Service Retirement

Will you be ready for retirement?

Retirement from your working career is one of the most important decisions of your life. CalPERS publications will help you plan your service retirement and provide information you need to consider before retiring.

You should consider your desired retirement lifestyle and project how much that lifestyle will cost. Then compare the lifestyle or the cost with your projected retirement income.

Sources of income may include:

- Your CalPERS Pension

- Deferred compensation, such as a 401(k) or 457 plan

- Social Security

- Other savings and investments

- Other factors such as taxes, inflation, health care costs, and estate planning may need your consideration as well.

Click here to view the full “CalPERS Benefits: Planning Your Service Retirement (PUB 1)”

CalPERS Retirement Application or Consultation

- Complete an online application for retirement at www.my.calpers.ca.gov or mail a completed paper version of the applications to CalPERS.

- Meet with a CalPERS representative at a local CalPERS office to complete the application

To approximate your pension upon retirement, employees may use the CalPERS Retirement Estimate Calculator online or complete and mail the Retirement Allowance Estimate Request to CalPERS.

Eligible for retirement and Medicare? Visit CalPERS and Social Security Administration websites for further information.

Additional Resources

CalPERS YouTube Videos

The County of Inyo has a Travel Reimbursement Policy that allows for some business travel expenses to be reimbursed.

Employees should contact their Department Supervisor for further information on processing a request for reimbursement of business travel expenses.

Here are some resources to avoid delays in getting your payment.

W2 Form- Frequently Asked Questions

Why did I receive a Form W-2?

If you received a Form W-2 from County of Inyo, you either received wages and/or had withholding or other information reported while employed with the County of Inyo. The Auditor-Controller’s Office for mailing all Form W-2s to employees paid by the County’s Payroll System. The federal Internal Revenue Service (IRS) requires employers to report employees’ wage and salary information on Form W-2. The Form W-2 also reports the amount of federal, state and other income taxes withheld from the employee’s paycheck during the calendar year.

When will my Form W-2 be mailed?

The County of Inyo, Office of the Auditor- Controller will mail the Form W-2s to all employees by January 31 of each year.

What if I have not received my Form W-2 or my mailing address has changed?

Contact the Personnel/Payroll Office after January 31. Undeliverable Form W-2s are returned to your Personnel/Payroll Office by the post office.

What wages are reflected on the Form W-2?

The Form W-2 reflects wages paid by warrants/direct deposit payments issued during the tax year, regardless of the pay period wages were earned. The Form W-2 includes warrants/payments with issue dates of January 1 through December 31 calendar year. The Form W-2 contains all wages and tax information for an employee regardless of the number of departments for which he or she worked during the tax year.

Why is the year-to-date gross on my final earnings statement different than what is shown in Box 1?

The year-to-date gross on the final earnings statement/direct deposit advice may not agree with Box 1 (Wages, Tips, Other Compensation) due to the following items:

- Accounts Receivable deductions

- Salary advances, fringe benefits, employee business expense reimbursements

- County Disability Insurance contributions

- Long Term Disability contributions

- Personal Use of a County Vehicle contributions

- Deferred Compensation deductions

- Pre-Tax Benefit deductions (Health, Dental, Vision, Voluntary Plans)

- Flex Benefit deductions

- Retirement contributions

- Short Term Disability payments

- Paid Family Leave payments

- Consolidated Benefits

What are the maximum wages subject to Social Security?

The maximum wages subject to Social Security changes each year. Box 4 (Social Security Tax Withheld) is computed based upon that year’s rate and the percentage of wages subject to Social Security. To view the annual maximum wage and contribution limits, click here.

What are the maximum wages subject to Medicare?

There is no maximum amount of wages subject to Medicare. Box 6 (Medicare Tax Withheld) is computed based upon that year’s rate and the percentage of wages subject to Medicare. To view the annual maximum wage and contribution limits, click here.

Note: Effective January 1, 2013, individuals with earned income of more than $200,000.00 pay an additional 0.9% in Medicare taxes.

Why did I not have any Social Security reported?

The County currently has a 218 agreement with Social Security for certain local government employees to contribute to the Social Security Administration.

Certain employee types are excluded from Social Security (FICA) benefits. If you are unsure of your employee type, you may contact Payroll or Personnel to verify.

Law enforcement/Safety employees who are covered by CalPERS retirement system are not currently contributing to Social Security (FICA).

Why are the wages reported in Box 1 Federal Wages different than Box 16 State Wages?

The amount in Box 16 state wages and Box 1 federal wages are usually the same. However, CA wages in Box 16 may differ from Box 1 federal wages for the following reasons:

- Family Leave Insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes. PFL benefits are not subject to California state income tax.

What is the Dependent Care maximum contribution?

Each tax year the maximum Dependent Care contribution per year per household or for a married individual filing a separate tax return can change. Deduction amounts withheld are reported in Box 10 (Dependent Care Benefits). Please refer to Personnel for additional plan information.

Are Fringe Benefits reported on the Form W-2?

Yes, fringe benefits are reported in Boxes 1 and 14 (Other). This amount will also be included in Boxes 3 and 5, if applicable.

Are Deferred Compensation Plans reported on the Form W-2?

Yes, employees who have Deferred Compensation deductions withheld will have the deduction amounts reported in Box 12 with codes “G” for 457(b)

What other amounts are reported in Box 12?

- Code “DD” - The cost of employer-sponsored health coverage. The amount reported is not taxable.

What is CDI and what are the maximum wages subject to the insurance?

The County of Inyo has a self-insured disability plan, County Disability Insurance (CDI). The maximum wages subject to SDI for the tax year may change. Box 14 (Other) CDI was computed at that year’s rate with an annual maximum contribution amount.

What other amounts are reported in Box 14?

- Code “LTD” - The cost of employer-sponsored long term disability.

- Code “PRETAX” – The cost of employee-paid voluntary pretax plans, like AFLAC.

- Code “H/INS”- The cost of employee-paid health insurance.

- Other information only items.

What should I do if I received a Form W-2 with an incorrect social security number or two or more Form W-2s with different social security numbers?

Contact your Personnel/Payroll Office regarding incorrect social security number.

Who should I contact for questions concerning federal or state income tax returns?

Any questions concerning federal or state income tax returns must be directed to the local Internal Revenue Service at (800) 829-1040 or Franchise Tax Board office at (800) 338-0505.

Website links:

Internal Revenue Service: Contact Your Local IRS Office | Internal Revenue Service

State of California Franchise Tax Board: Phone / fax | FTB.ca.gov

Who should I contact if I have any further questions about my Form W-2?

You may contact the Payroll Office with any further questions.

How do I request a duplicate Form W-2?

Form W-2's are mailed out to your home address; if you did not receive your Form W-2 or would like to request a duplicate to be issued, contact the Payroll Office.

Wage Garnishments and Earnings Withholding Orders

Court Ordered Earning Withholding Order for Support, Taxes, Vehicle Registration, Wage Garnishments and Levies

Wage garnishments can be sent to:

Inyo County Office of the Auditor-Controller: Payroll

760-878-0257

760-878-0391, Fax

ADDRESS:

PO Drawer “R”

Independence, California 93526

Inyo County Sheriff’s Office Levy Officer:

Civil Officer: Kim Geiger, kgeiger@inyocounty.us

760-878-0329

760-878-0389, Fax

ADDRESS:

550 South Clay Street

PO Box “S”

Independence, California 93526

Voluntary Wage Assignments

The County of Inyo does not voluntary withhold from employee earnings.

We will not process any request unless it is required to be honored by law.